Ncua Insurance Brochure

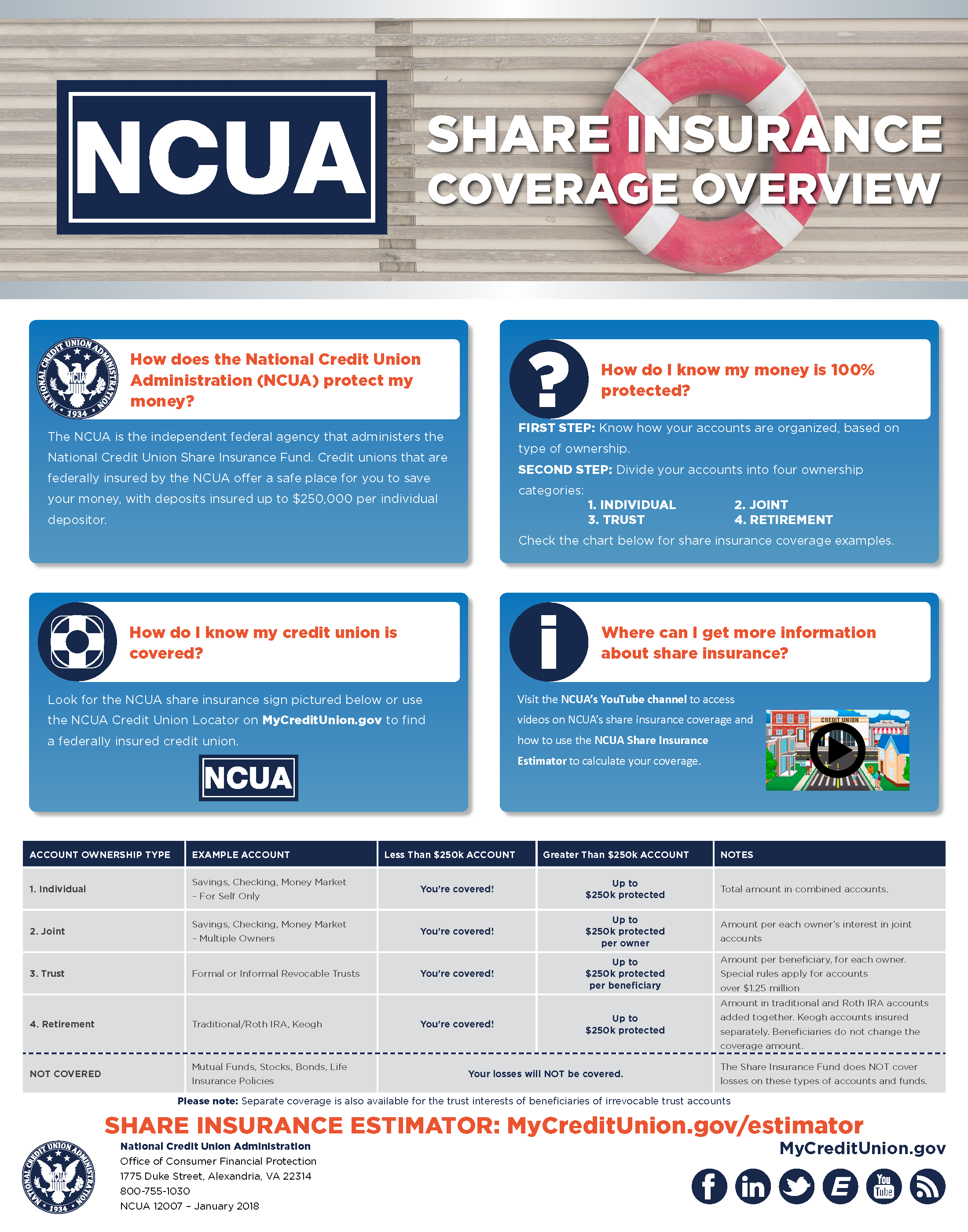

Ncua Insurance Brochure - Credit unions that are federally insured by the ncua offer a. A brochure entitled your insured funds is available at ncua’s internet site this comprehensive brochure contains a detailed discussion of all available types of coverage offered by the. Credit unions that are insured by the ncusif must display in their offices the official ncua insurance sign, which appears on the cover of this booklet. Consumer related brochures and publications on topics like share insurance coverage, financial literacy and money transfers are also available for download on ncua’s. All federal credit unions must be. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. To submit comments, find your. Because the scope of this brochure is limited, credit union. Check out our website to learn about regulations and ncua insurance. Enjoy quick access to healthcare associates credit union's disclosure agreements. Credit unions that are insured by the ncusif must display in their offices the official ncua insurance sign, which appears on the cover of this booklet. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. How can i get more information?. Enjoy quick access to healthcare associates credit union's disclosure agreements. View or download one of the ncua share insurance resources and learn how the ncua protects your money. A brochure entitled your insured funds is available at ncua’s internet site this comprehensive brochure contains a detailed discussion of all available types of coverage offered by the. All federal credit unions must be. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. The ncua is the independent federal agency that. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. How does the national credit union administration (ncua) protect my money? Educate your members about ncua's share insurance coverage with these professionally designed brochures. Credit unions that are federally insured by the ncua offer a. Because the scope of this brochure is limited, credit union. The ncua’s rules and regulations allow credit union members to comment on the proposed merger. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. How can i get more information?. Because the scope of this brochure is limited, credit union. The ncua is the independent federal agency that administers the national credit union share insurance fund. Credit. The standard share insurance amount is $250,000 per share owner, per insured. Because the scope of this brochure is limited, credit union. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. Credit unions that are federally insured by the ncua offer a. Because the. Educate your members about ncua's share insurance coverage with these professionally designed brochures. Consumer related brochures and publications on topics like share insurance coverage, financial literacy and money transfers are also available for download on ncua’s. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their. A brochure entitled your insured funds is available at ncua’s internet site this comprehensive brochure contains a detailed discussion of all available types of coverage offered by the. How does the national credit union administration (ncua) protect my money? All federal credit unions must be. The ncua is the independent federal agency that administers the national credit union share insurance. Because the scope of this brochure is limited, credit union. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. Enjoy quick access to healthcare associates credit union's disclosure agreements. How does the national credit union administration (ncua) protect my money? The ncua’s. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. Enjoy quick access to healthcare associates credit union's disclosure agreements. To submit comments, find your. Consumer related brochures and publications on topics like share insurance coverage, financial literacy and money transfers are also available for download on ncua’s. The ncua is the independent federal agency. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. Educate your members about ncua's share insurance coverage. To submit comments, find your. View or download one of the ncua share insurance resources and learn how the ncua protects your money. Credit unions that are insured by the ncusif must display in their offices the official ncua insurance sign, which appears on the cover of this booklet. The ncua’s rules and regulations allow credit union members to comment. All federal credit unions must be. Credit unions that are federally insured by the ncua offer a. How can i get more information?. The ncua’s rules and regulations allow credit union members to comment on the proposed merger of two federally insured credit unions. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. This brochure provides examples of insurance coverage under the national credit union administration’s (ncua) rules. Check out our website to learn about regulations and ncua insurance. The ncua is the independent federal agency that administers the national credit union share insurance fund. Educate your members about ncua's share insurance coverage with these professionally designed brochures. The ncua is the independent federal agency that. Credit unions that are insured by the ncusif must display in their offices the official ncua insurance sign, which appears on the cover of this booklet. Because the scope of this brochure is limited, credit union. Consumer related brochures and publications on topics like share insurance coverage, financial literacy and money transfers are also available for download on ncua’s. Federally insured credit unions are required to indicate their insured status in their advertising and to display the oficial ncusif insurance sign in their ofices and branches. Enjoy quick access to healthcare associates credit union's disclosure agreements. This is a comprehensive brochure describing how credit union member accounts are insured by the national credit union administration (ncua), an agency of the federal. Insurance purposes and insured for a total of $250,000 that is separate from and in addition to the coverage the ncusif provides for other types of accounts. Credit union members can download, view, and print the following brochures, which are available in english and spanish, for more information about. A brochure entitled your insured funds is available at ncua’s internet site this comprehensive brochure contains a detailed discussion of all available types of coverage offered by the. The ncua’s rules and regulations allow credit union members to comment on the proposed merger of two federally insured credit unions. All federal credit unions must be.NCUA Share Insurance Brochure Folded 4 Panel Brochure

Ncua Magazines

How Your Accounts Are Federally Insured Hawaiian Financial Federal

How Your Accounts Are Federally Insured Hawaiian Financial Federal

Best Practices to Keep Your Money Insured

Your Money is Federally Insured Through the NCUA

How Your Accounts Are Federally Insured Hawaiian Financial Federal

NCUA Brochure for Credit Unions Your Insured Funds

NCUA Booklet Your Insured Funds Pack of 50

NCUA Insurance by Hudson River Community Credit Union Issuu

The Standard Share Insurance Amount Is $250,000 Per Share Owner, Per Insured.

To Submit Comments, Find Your.

View Or Download One Of The Ncua Share Insurance Resources And Learn How The Ncua Protects Your Money.

For A Complete Directory Of Federally Insured Credit Unions, Visit The Ncua’s Agency Website At Ncua.gov.

Related Post: